Some Known Details About Hard Money Georgia

Wiki Article

The Only Guide to Hard Money Georgia

Table of ContentsSome Of Hard Money GeorgiaSome Known Incorrect Statements About Hard Money Georgia 3 Simple Techniques For Hard Money Georgia3 Simple Techniques For Hard Money Georgia7 Simple Techniques For Hard Money Georgia

Among the most significant differences between a hard cash finance and also a conventional lending is that hard cash loan providers utilize the worth of the residential property versus the customer's credit reliability to establish the car loan. This functions in favor of capitalists who plan to acquire a residence in requirement of repair services, rehab it and also sell it rapidly for a profit on their actual estate financial investment. One of the biggest advantages of a tough cash financing is there are much less constraints with difficult money car loans when.

Time is money in actual estate and time is on your side with tough cash. Tough money loans likewise offer remarkable leverage for solution and also flip as well as acquire and hold financiers.

The Best Guide To Hard Money Georgia

Check Out Investor Financing Source to read more, or follow them on Connected, In, Facebook, and also Twitter. Published in Exactly How To Retire Well Self Directed IRAs. This device numbers month-to-month settlements on a difficult money loan, supplying settlement quantities for P&I, Interest-Only as well as Balloon repayments together with providing a month-to-month amortization routine. This calculator immediately figures the balloon settlement based on the entered lending amortization duration. If you make interest-only repayments after that your month-to-month settlements will certainly be the interest-only repayment amount listed below with the balloon settlement being the original quantity borrowed.While financial institutions and cooperative credit union provide business loans, not everybody can access them. Standard industrial home loans enforce rigorous underwriting treatments that take a very long time to get approved (3 months or even more). They call for high credit history and evidence that your firm has sufficient capital to repay the mortgage.

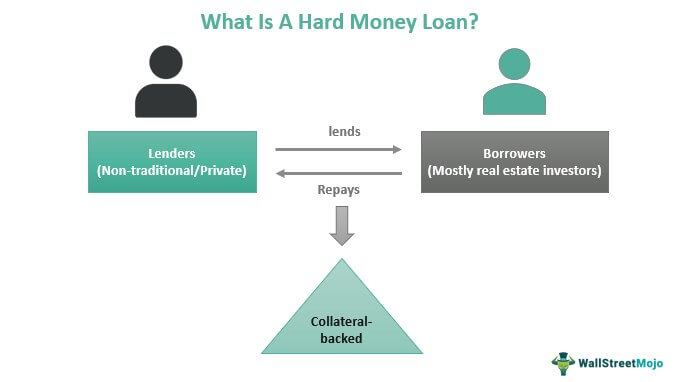

If you can not secure a typical business financing, you can turn to hard money loan providers. These are private investors that supply financing based on the residential property you are using as collateral. Exactly how do they work? In this article, we'll discuss hard cash loan requirements, its repayment framework, as well as prices.

What are Difficult Cash Lendings? Unlike business fundings from financial institutions, hard money car loans are based on property being utilized as security instead than the customer's creditworthiness.

Facts About Hard Money Georgia Revealed

This is typically considered the last resource if you are unqualified for standard commercial financing. Financial experts state difficult describes the nature of the lending, which is challenging to finance by traditional requirements. Nevertheless, others say it refers to the collateral of the financing being a tough property, which is the actual estate property protecting the funding.Visit Financier Funding Source to read more, or follow them on Connected, In, Facebook, and Twitter. Uploaded in Exactly How To Retire Well Self Directed IRAs. This tool figures more helpful hints regular monthly settlements on a tough cash car loan, using payment quantities for P&I, Interest-Only as well as Balloon settlements together with giving a regular monthly amortization timetable. This calculator automatically figures the balloon settlement based upon the entered lending amortization find out duration. If you make interest-only repayments then your month-to-month settlements will be the interest-only repayment quantity below with the balloon repayment being the initial quantity borrowed.

While banks as well as debt unions offer commercial fundings, not everybody can access them. Traditional business home mortgages enforce stringent underwriting treatments that take a long period of time to get authorized (3 months or more). They require high credit rating and proof that your company has sufficient capital to settle the home loan.

If you can not protect a standard business funding, you can turn to difficult money loan providers. In this post, we'll speak regarding tough cash car loan demands, its settlement structure, and also prices.

The 3-Minute Rule for Hard Money Georgia

What are Tough Cash Loans? Unlike industrial fundings from banks, tough money finances are based on residential or commercial property being used as collateral rather than the debtor's credit reliability (hard money georgia).This is frequently taken into consideration the last resource if you are unqualified for traditional industrial funding. Economists state difficult refers to the nature of the financing, which is difficult to finance by conventional criteria. Others claim it refers to the security of the finance being a tough property, which is the genuine estate home safeguarding the financing.

This device figures month-to-month payments on a hard cash loan, offering repayment amounts for P&I, Interest-Only and also Balloon payments along with offering a monthly amortization schedule. This calculator automatically figures the balloon payment based on the entered financing amortization period. If you make interest-only settlements after that your month-to-month payments will be the interest-only payment quantity below with the balloon payment being the original quantity obtained.

While financial institutions and credit unions supply business lendings, not everybody can access them. Traditional business mortgages enforce rigid underwriting treatments that take a long period of time to obtain authorized (3 months or more). They require high credit rating and evidence that your firm has sufficient cash circulation to pay back the mortgage.

The Single Strategy To Use For Hard Money Georgia

If you can not protect a standard commercial funding, you can look to tough money loan providers. These are personal capitalists who use funding based on the Related Site residential property you are using as security. However just how do they work? In this short article, we'll chat about hard money lending needs, its repayment structure, and rates.What are Hard Money Car Loans? Unlike commercial car loans from banks, tough cash loans are based on building being used as security instead than the consumer's creditworthiness.

Report this wiki page